It held as assets of $118.9 billion in single-family loans, of which $52.9 billion were "option adjustable rate mortgages" (option ARMs), with $16 billion in subprime mortgage loans, and $53.4 billion of Home Equity lines of Credit (HELOCs) and credit cards receivables of $10.6 billion. It held liabilities in the form of deposits of $188.3 billion, and owed $82.9 billion to the Federal Home Loan Bank, and had subordinated debt of $7.8 billion. On June 30, 2008, WaMu had total assets of $307 billion, with 2,239 retail branch offices operating in 15 states, with 4,932 ATMs, and 43,198 employees. Business operations prior to bank receivership A former WaMu branch in the Chinatown section of New York City (2004)ĭespite its name, WaMu ceased being a mutual company in 1983 when it demutualized and became a public company on March 11. JPMorgan Chase promptly filed a counterclaim in the Federal Bankruptcy Court in Delaware, where the WaMu bankruptcy proceedings had been continuing since the Office of Thrift Supervision's seizure of the holding company's bank subsidiaries. On March 20, 2009, WaMu filed suit against the FDIC in the United States District Court for the District of Columbia, seeking damages of approximately $13 billion for an alleged unjustified seizure and unfair low sale price to JPMorgan Chase. Īccording to WaMu Inc.'s 2007 SEC filing, the holding company held assets valued at $327.9 billion. īefore the receivership action, it was the sixth-largest bank in the United States.

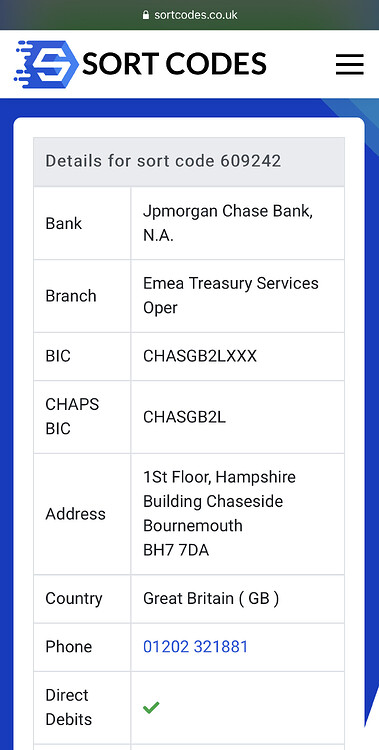

Regarding total assets under management, WaMu's closure and receivership is the largest bank failure in American financial history. filed for Chapter 11 voluntary bankruptcy in Delaware, where it was incorporated. The holding company, WaMu, Inc., was left with $33 billion in assets, and $8 billion in debt, after being stripped of its banking subsidiary by the FDIC. All WaMu branches were rebranded as Chase branches by the end of 2009. The FDIC sold the banking subsidiaries (minus unsecured debt and equity claims) to JPMorgan Chase for $1.9 billion, which had been considering acquiring WaMu as part of a plan internally nicknamed "Project West". The OTS took the action due to the withdrawal of US$16.7 billion in deposits during a 9-day bank run (amounting to 9% of the deposits it had held on June 30, 2008). On September 25, 2008, the United States Office of Thrift Supervision (OTS) seized WaMu's banking operations and placed it into receivership with the Federal Deposit Insurance Corporation (FDIC).

Washington Mutual (often abbreviated to WaMu) was the United States' largest savings and loan association until its collapse in 2008. Archived official website at the Wayback Machine (archive index)

0 kommentar(er)

0 kommentar(er)